Tax professionals in India are increasingly adopting AI accounting software to streamline operations, improve client service, and ensure compliance.

With tax laws evolving rapidly and the need for real-time accuracy intensifying, AI-driven solutions are indispensable.

This blog highlights the best AI accounting software for tax professionals in India in 2026, focusing on key features and how AI tools are revolutionising the industry.

Tax professionals, including chartered accountants, GST practitioners, and tax consultants, are under constant pressure to manage vast amounts of data, meet complex tax compliance requirements, and deliver timely advice.

Industry Challenges for Tax Professionals in India

Tax professionals in India face numerous challenges in managing client data and ensuring compliance with the ever-evolving tax laws.

You can check this to understand the frustration of Tax professionals:

These challenges create the need for powerful AI accounting tools.

Manual Workflows & Operational Bottlenecks

Many firms still rely heavily on manual processes for data entry, reconciliation, and tax filing. This results in:

- Time-consuming data entry: Extracting data from invoices, bank statements, and receipts is a manual process prone to errors.

- Client follow-ups: Constant communication is necessary to collect documents and information, which can hinder productivity.

- Compliance stress: With the increasing complexity of GST filings, TDS, and income tax returns, ensuring accuracy and compliance can be overwhelming.

Compliance & Regulatory Pressure

Frequent updates to tax laws, such as GST amendments and new filing formats, make it difficult for tax professionals to stay ahead. Some common concerns include:

- GST and income tax compliance: Mismatches in GST returns, changes in TDS rates, and e-way bill updates require professionals to stay constantly updated.

- Risk of non-compliance: Incorrect filings can result in penalties, making compliance a critical area of focus.

Technology Adoption & Strategic Positioning

Many tax firms are stuck in the execution phase, focusing on data entry and filing rather than moving to higher-value advisory services.

Technology adoption provides a means to scale client services and achieve better client outcomes.

- Automation of routine tasks allows firms to free up time for strategic insights.

- Practice management: Tracking tasks and client communication seamlessly is essential for better workflow.

What to Look for in AI Accounting Software (for 2026)

When selecting AI accounting software, tax professionals must consider several key factors to ensure they choose the right tool for their firm’s needs.

Core Features & Evaluation Criteria

Here are the essential features every tax professional should look for in AI accounting software:

- Automation: The software should automate tasks such as data entry, reconciliation, and tax filing to save time and minimise errors.

- GST Compliance: The platform must support GST filings, input tax credit reconciliation, and e-invoice generation.

- Integration: The software should integrate seamlessly with popular tools like Tally and the GST portal for smooth workflows.

- Scalability: As your firm grows, the software should scale without requiring additional resources.

- Security: It should offer robust data protection with encryption, secure cloud storage, and audit trails.

- User-Friendliness: Ensure that your team can easily adapt to the software with minimal training.

Indian Tax-Specific Features

For tax professionals in India, the software must align with local tax requirements, such as:

- GST Formats: Ensure support for GSTR-3B, GSTR-1, GSTR-9, etc.

- E-Way Bills: Track and generate e-way bills directly from the software.

- Client Document Collection: Allow clients to submit documents via mobile apps, WhatsApp, or email for easy data collection.

Suvit: AI Accounting Software for Indian Tax Professionals

Overview of Suvit

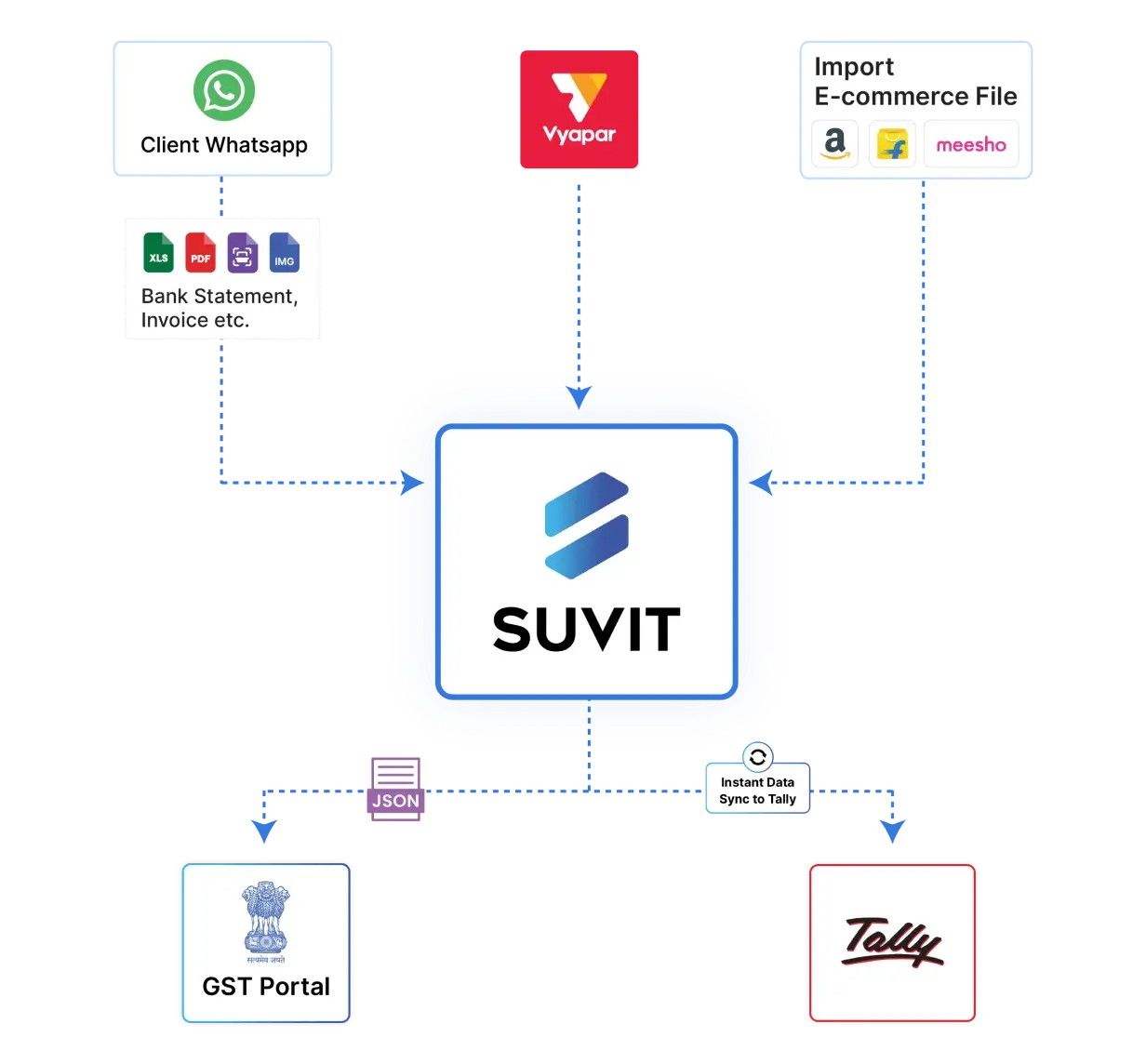

Suvit is a leading AI-powered accounting software tailored specifically for tax professionals in India. It focuses on automating the most tedious aspects of accounting, such as data entry, GST filing, and client communication, allowing tax professionals to redirect their focus toward higher-value services like tax planning and strategic advice.

Key Features & Benefits

Suvit offers a range of features that set it apart from traditional accounting software:

- Data Entry Automation: Suvit automates the extraction of data from bank statements, invoices, and receipts, significantly reducing manual entry errors and time spent.

- GST Filing & Reconciliation: Suvit simplifies the process of preparing and filing GST returns. It automatically reconciles GST input tax credits and generates the necessary reports, reducing the risk of mismatches.

- Client Communication & Practice Management: With Suvit’s integrated client portal, tax professionals can manage tasks, track client communications, and gather documents effortlessly.

- Scalability: Suvit enables firms to onboard new clients without incurring increased operational costs. Its easy-to-use interface ensures that both experienced professionals and junior staff can operate it efficiently.

Why Suvit is Perfect for Indian Tax Firms

- Tailored for India’s Tax System: Suvit supports Indian tax formats and integrates seamlessly with the GST portal, as well as tools like Tally, Vyapar, and WhatsApp.

- Competitive Pricing: With plans starting as low as ₹10,000/year, Suvit offers a cost-effective solution for firms of all sizes, with discounts available for larger practices.

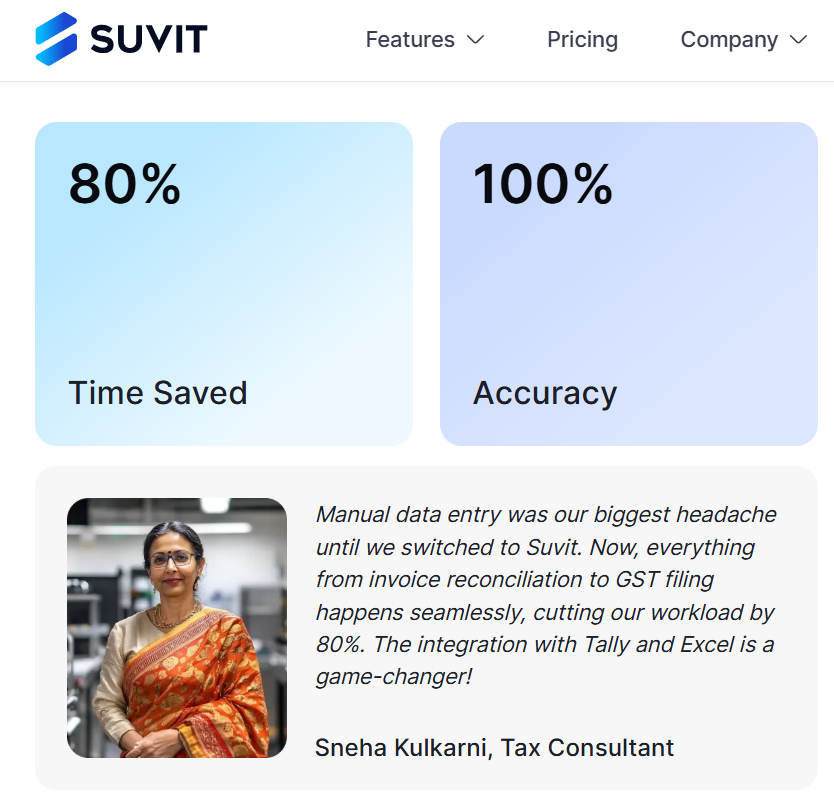

- Proven Results: Suvit reduces the time spent on routine accounting tasks by up to 80%, allowing firms to focus on client advisory services. Read Sneha Kulkarni’s review backing this.

Selecting the Right AI Accounting Software for Your Firm

Here’s a step-by-step guide for selecting AI accounting software tailored to your firm’s needs in 2026:

- Define Your Needs: Identify the tasks that consume the most time (e.g., GST filing, data entry) and the features you need (e.g., automation, client portal).

- Evaluate Options: Shortlist software like Suvit, which provides AI-driven automation specifically designed for Indian tax professionals.

- Run a Pilot Program: Implement the software for a subset of clients and track improvements in efficiency and accuracy.

- Measure ROI: Track key metrics, such as time saved, error reduction, and client satisfaction, to determine the software's effectiveness.

- Training: Train your staff to use the software efficiently. Suvit’s user-friendly interface ensures minimal training time.

- Scale: Once you see positive results, roll out the software across your practice.

Future-Proof Your Tax Practice with Suvit AI Software

For tax professionals in India, choosing the right AI accounting software in 2026 is vital for staying competitive, improving client service, and ensuring compliance.

Tools like Suvit offer a comprehensive, automated solution that reduces manual effort, improves accuracy, and frees up time for value-added advisory services. By leveraging the latest AI-driven technologies, tax firms can scale efficiently, meet the evolving regulatory landscape, and deliver higher-quality services to clients.

Ready to streamline your accounting process and improve compliance? Explore Suvit today and experience the future of tax practice management.

FAQs

1. Which is the best AI tool for accounting?

Suvit is one of the best AI tools for accounting, automating data entry, reconciliation, and reporting to save time and reduce errors.

2. How can tax accountants use AI?

Tax accountants can use Suvit to automate bookkeeping, extract data from invoices, prepare GST and TDS reports, and streamline compliance tasks efficiently.

3. Is Suvit suitable for small tax firms?

Yes, Suvit offers scalable solutions that can grow with your firm. Its user-friendly interface makes it ideal for both small and large practices.

4. What are the key benefits of using AI accounting software?

AI accounting software, such as Suvit, saves time, reduces errors, automates manual tasks, and enables tax professionals to focus on higher-value advisory services.

5. How do I get started with Suvit?

You can start with a free trial by visiting Suvit, allowing you to explore its features and see how it can benefit your practice.